The US Government successfully, yet wrongly, convicted Michael Quiel on one charge (Quiel was found not guilty on everything else) – the government lied during testimony to get the jury to believe them. Now, the government wants Tax Money it was never owed.

By US~Observer Staff

Michael Quiel

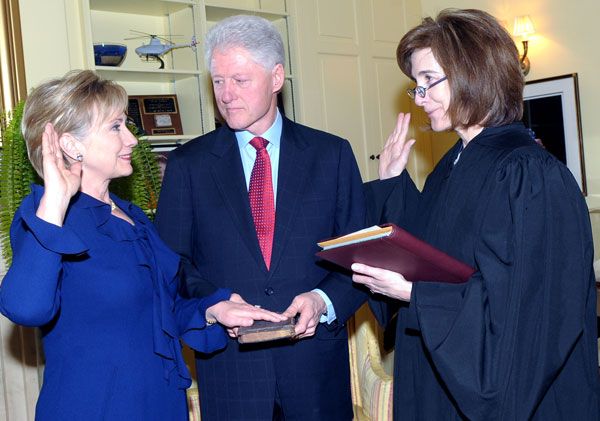

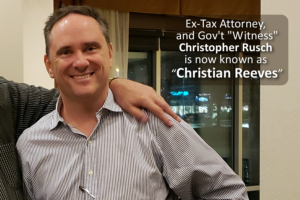

Phoenix, AZ – Amidst the intricate legal saga surrounding Michael Quiel, shocking revelations emerge of government lawyers conspiring with Quiel’s own attorney, Christopher Rusch (AKA Christian Reeves), to secure a false conviction. The 2013 criminal trial, which saw Quiel facing a litany of charges, now stands as a testament to potential collusion that tarnishes the integrity of the legal process.

The false charges brought against Quiel in 2013 included conspiracy, filing false tax returns for 2007 and 2008, and failure to file FBARs (Foreign Account Reporting Forms) for the same years. Rusch, the only conspirator, pleaded guilty to conspiracy, while Quiel was acquitted of the conspiracy charge, and failure to file FBARs, casting doubt on the coherence of the prosecution’s case.

Examining the charges raises perplexing questions. Rusch, as Quiel’s advisor, recommended against filing FBARs, a fact acknowledged by the jury in their acquittal on the conspiracy and FBAR charges. The crux of the matter lies in the contradiction: if Quiel, guided by his advisor, believed he wasn’t obligated to file FBARs, can he be held criminally liable? The inconsistencies underscore the questionable foundation of the government’s case against Quiel. How could he have been convicted of filing false tax returns when there was no conspiracy and no failure to file FBARs?

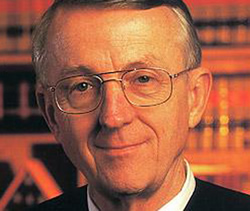

Judge James Teilborg

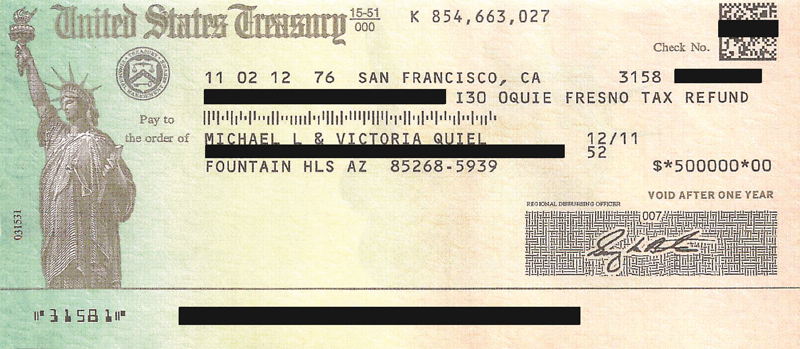

At sentencing, US District Judge James Teilborg, acknowledging compelling evidence, ruled that Michael Quiel owed nothing in taxes – ZERO. Despite this ruling, Quiel, deemed not a conspirator, now faces the government’s pursuit to financially ruin him through substantial tax demands in a civil suit brought by the government.

Christopher Rusch aka Christian Reeves

Rusch, alias Christian Reeves, escaped significant consequences and has since continued selling offshore investment schemes, while the government, fully aware of Rusch’s activities, has seen its involved personnel either promoted or retired in the decade since the trial. In stark contrast, Michael Quiel, steadfast in his belief of eventual vindication, has spent over $15 million defending himself and challenging the wrongful conviction.

The narrative of Quiel’s legal ordeal is one that unveils a disconcerting alliance between government actors and Quiel’s own attorney, raising profound concerns about the erosion of justice and the urgent need for a thorough reexamination of Quiel’s case. As Quiel battles not just for his innocence but also against the financial repercussions of a flawed conviction, the overarching question persists: How deeply does the web of collusion extend within the corridors of justice?

Quiel Tax Audit and Rusch’s Involvement

IRS Agent Cheryl Bradley

In 2006, Michael Quiel found himself under the scrutiny of an IRS audit for tax years 2000 to 2003, with Agent Cheryl Bradley leading the investigation. The focus was on a corporate credit card Quiel had used, issued by a Belize corporation. Christopher Rusch, a self-proclaimed offshore tax expert, entered the scene when Quiel sought legal representation.

Rusch, Quiel’s chosen advisor, collaborated with IRS Agent Bradley to negotiate a settlement. A condition of the settlement compelled Quiel to add $220,000 in charges from the Belize credit card to his personal tax returns for the specified years. The tax returns were amended by Rusch, acting as the preparer, and the settlement concluded with Quiel paying taxes and fines in full for 2000 to 2003.

The Swiss Bank Venture and Criminal Investigation

Post-audit, Rusch enticed Quiel into various offshore ventures, including a 4% ownership investment in a Swiss Bank operated by Rusch. Despite Rusch’s representation and advice, the Swiss Bank venture turned out to be a scam, leading to a criminal investigation in 2010. Accused of conspiring to hide money offshore, Quiel was acquitted of the charges in 2013.

During the trial, Rusch, now a key witness for the government, testified against Quiel, contradicting his earlier role as Quiel’s tax advisor and attorney. The trial hinged on Rusch’s alleged preparation and filing of amended tax returns, including the reporting of a foreign bank account on Schedule B and FBARs.

Conspiracy and Withheld Evidence

The trial, marred by perjury, saw the government presenting a prior audit of the Belize credit card as a focal point. Rusch’s contradictory roles, including being Quiel’s attorney and lead witness for the government, added complexity. Crucially, the IRS withheld Quiel’s Internal Master File (IMF) during trial, containing evidence that would have contradicted the government’s narrative.

Quiel’s defense repeatedly sought access to his IMF file, but Judge Teilborg denied the requests, culminating in a guilty verdict on filing false tax returns for 2007 and 2008. The government’s refusal to release Quiel’s tax returns concealed the truth, perpetuating a flawed narrative that contributed to his conviction.

Civil Pursuit and New Co-Conspirators

Years later, a civil case has been brought against Quiel, seeking $2.1 million in fines associated with tax violations for the years previously determined by the court that Quiel owed nothing. Armed with his IMF file, Quiel exposes the government’s conspiracy and perjury, implicating Rusch, Bradley, and others, including the court, in a deceitful narrative. Yet, new government co-conspirators, Tijuhna Green, Charles Butler, and Matthew Uhalde, now spearhead the civil pursuit, using evidence and testimony now discredited.

As Quiel fights not just for innocence but against financial ruin, the resilience of these alleged conspirators raises questions about the pursuit of justice and the lengths to which they will go to maintain a false narrative.

Michael Quiel is highly commended for continuing his fight for justice, literally, at all costs. The government can make every attempt to twist the facts of Quiel’s case, but they can never change the truth that has been clearly established on the record – Michael Quiel owed NO taxes, and he did everything to follow the law, unlike his attorney!