Latest News

IRS Gives Refund Check to Man for Paying Too Much, While Claiming to the Court He Avoided Paying Taxes

- April 7, 2020

- admin

- No Comments

This is the second in a series of articles focusing on the false conviction of Michael Quiel.

By Ron Lee

US~Observer

In 2012, Michael Quiel was already fighting for his freedom and his very life against the Internal Revenue Service (IRS) and Department of Justice’s (DOJ) false allegations that he had tried to hide assets offshore to avoid taxes. The sum of those alleged assets should have generated large tax liabilities – meaning he’d owe a lot in taxes. As such he was advised by his attorney Michael Minns to pay the IRS $500,000.00, just in case they found he owed taxes. He immediately paid the IRS. What happened next shows the truth of the matter.

As mentioned in our previous article, throughout Michael Quiel’s 2013 trial the federal prosecutor and witnesses ran rampant, waging an all-out war on Quiel by committing fraud on the court. In fact, as we will uncover in this series of short articles relating to Michael Quiel’s false prosecution and subsequent conviction, the entire government’s case was built around a fraudulent hypothesis. This supposition only worked if they could have the truly guilty party, Michael Quiel’s former tax attorney Christopher Rusch, portray that Quiel as the orchestrator in a conspiracy to defraud the United States government of tax revenue. The only problem was that all the facts showed something far different.

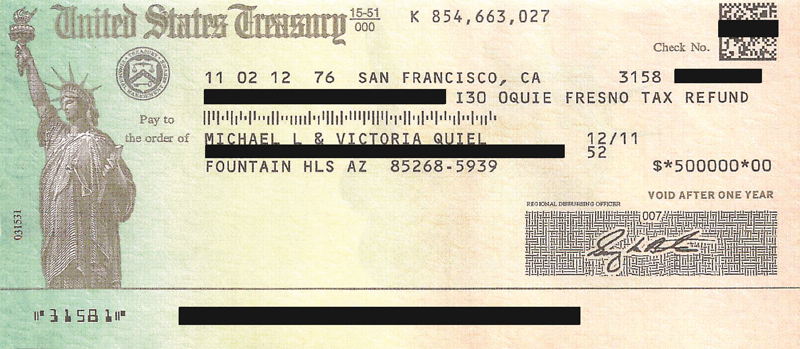

Seven months after sending the IRS the $500,000 payment, Michael Quiel received a check back from the IRS and a special notice. It wasn’t until the closing arguments of Quiel’s 2013 trial that those two items were brought to the jury’s attention by Quiel’s attorney Michael Minns.

Minns revealed that Quiel had received a complete refund of what he had paid – all $500,000.00 of it. Not only that, he read a letter from the IRS stating that in addition to the refund check, due to business losses, Quiel had a $1.4 million credit with the government which could apply to past or future tax years.

From Michael Quiel’s book, Rigged, “So the supposed ‘victim’ in this case—the U.S. Treasury—in fact owed me over a million dollars. Minns went on to explain that a person can be held criminally liable in a tax case only if it can be clearly shown that he or she willfully intended to do wrong.” Owing nothing clearly shows Michael Quiel had no reason to do anything wrong.

It leaves one wondering how he could have been prosecuted in the first place, let alone convicted of anything.

In our next look at Quiel’s wrongful conviction we’ll show the political reasons for his prosecution, and the need for a guilty verdict. Let’s just say, not all Clinton bodies wind up cold, some just get burned at the altar of “justice.”

Quiel’s book, Rigged – due out soon – does an excellent job of outlining the entire case, that is still going on to this day. All profits from the sale of his book will be donated to benefit innocent victims of false charges and prosecution. Michael Quiel is adamant that he help as many people as he can from ever having to go through the same type of abuse he endured at the hands of prosecutors who turn a blind eye to truth and justice.

Related Stories

Michael Quiel’s recent triumph regarding the financial interest issue will exonerate him from his wrongful conviction in 2013!!

Innocence Amid Government Conspiracy

Civil Attorneys Butler, Hubbert and Uhalde Become Co-Conspirators

Becoming a Judge by Convicting the Innocent?

IRS Relies on Fraudulent Evidence to Collect Fines and Taxes

Chris Rusch aka Christian Reeves Continues Crimes

FOX NEWS STORY

Clinton “Killing Machine” Destroyed Phoenix Man

Attorney Turned IRS Informant

Attorney Rusch turns on clients, Gov’t fails to prove tax due

CLINTON TIES TO UBS

Update 2 – Judge Tielborg ignored two recent Supreme Court of the United States (SCOTUS) opinions

DOJ and IRS publish Quiel family members social security numbers on the internet and cause identity theft.

Fraud on the Court Through Prosecutorial Misconduct

TEILBORG OPINION AND IRS COVERUP